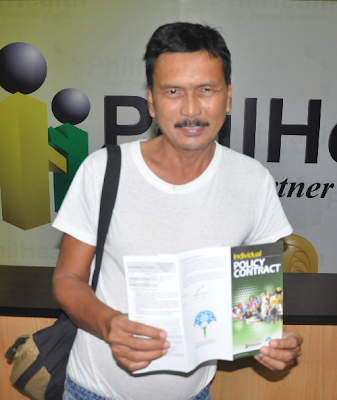

Starting January 1, 2013 all Individually Paying Members (IPMs) shall be issued an Individual Policy Contract (IPC).

PhilHealth

XII Regional Vice-President, Ramon F. Aristoza Jr. explained that “the IPC is intended to guide and encourage

IPMs to sustain active participation in the National Health Insurance Program (NHIP)

and guarantee entitlement to PhilHealth benefits thereby providing continuous

financial risk protection in health care costs within a specified validity

period.”

Upon signing of IPC, an IPM shall be required to

pay a minimum initial premium

contribution according to the number of years contracted which is: Php450.00 or

25% of the annual premium for 1 year validity, Php900.00 or 50% of the annual

premium for 2 years validity and Php1,800.00 or 1 year full payment for 3 years

validity.

Full

payment of premium contributions upon contract signing shall be locked in to

the current rate which is Php1,800.00 per year. For those who opt to pay only

the initial minimum premium requirement, succeeding payments may be paid on a

monthly, quarterly, semi-annual or annual mode.

Payments

shall be applied prospectively and deadline shall be on the last working day of

the month prior to the applicable period being paid.

Grace

period shall be allowed for delayed remittance and may vary according to

selected mode of payment.

Example:

Mode of

payment

|

Deadline

|

Example

|

Grace Period

|

Example

|

Monthly

|

On or before the last working

day of the month prior to the applicable month

|

January 31, 2013

(for February 2013 premium)

|

5days

|

February

1-5, 2013

|

Quarterly

|

On or before the last working

day of the month prior to the applicable three-month period

|

March 27, 2013

(for April-June 2013premium)

|

10days

|

April 1-10, 2013

|

Semi-annual

|

Or before the last working day

of the month prior to the applicable six-month period

|

June 28, 2013

(for July-December 2013)

|

15days

|

July 1-15, 2013

|

Annual

|

On or before the last working

day of the month prior to the applicable twelve-month period

|

December 27, 2013

(for

January-December 2014 premium)

|

30days

|

January 1-30, 2014

|

A

3% interest charge for payment made after the grace period or a succeeding late

remittance within a 12-month fiscal year IPC validity shall be applied. However,

it will be allowed only once within a 12-month period.

The

initial premium contribution and Policy Validity Period with succeeding payment

schedule are indicated in the IPC. An enhanced Member Data Record (MDR) showing

the same details will also be issued to the member.

To

avail of benefits, the IPC shall serve as one of the primary documents for IPMs

and their qualified dependents to submit.

RVP

Aristoza said that IPMs who are issued IPC shall be entitled to avail of

benefits based on the 3/6 minimum premium requirement for all type of illnesses,

except for Case Type Z illnesses which requires 1 year advance full payment of

premium contribution.

Further,

he added that “a member is also assured

of no disruption of benefits entitlement.” In case of default or missed

payment, a member shall be allowed to pay his/her overdue premium plus the

applicable interest charges within 60 days from date of discharge.

Filing

of claims for those with premium arrears paid shall be made directly to the

nearest PhilHealth Office. “PhilHealth

frontliners will assist the IPM on the procedures for direct filing”,

assured RVP Aristoza.

In

case of death of member, the dependents may continue to avail of NHIP benefits

for the period already paid in advance. (amorsequito, proxii)